Hey there, tax enthusiast! If you’ve stumbled upon this page, chances are you’ve been scratching your head about the Colorado 1099-G tax refund situation. Let’s dive right into it, shall we? The 1099-G form is like a little secret weapon for anyone who received unemployment benefits, government payments, or even state tax refunds during the year. This form plays a crucial role in your federal tax return, and if you’re not careful, it might cost you big time. Colorado 1099-G tax refund is a game-changer for those who want to ensure they’re not leaving money on the table. So, let’s break it down step by step.

Now, before we get too deep into the nitty-gritty, let’s talk about why this matters. If you live in Colorado and received any kind of government payment in the past year, you’re probably wondering how it affects your tax refund. The Colorado 1099-G tax refund isn’t just a form; it’s a roadmap to understanding your financial obligations and opportunities. Whether you’re a freelancer, a small business owner, or someone who received unemployment benefits, this guide is for you.

But hold up—don’t panic if you’re not a tax wizard. We’re here to simplify things for you. This article isn’t just about dumping a bunch of numbers and jargon on you. It’s about empowering you to take control of your finances and make sure you’re getting the most out of your tax situation. Let’s roll!

Read also:Tobias Dorzon Nfl Career A Comprehensive Analysis

What is the Colorado 1099-G Tax Refund All About?

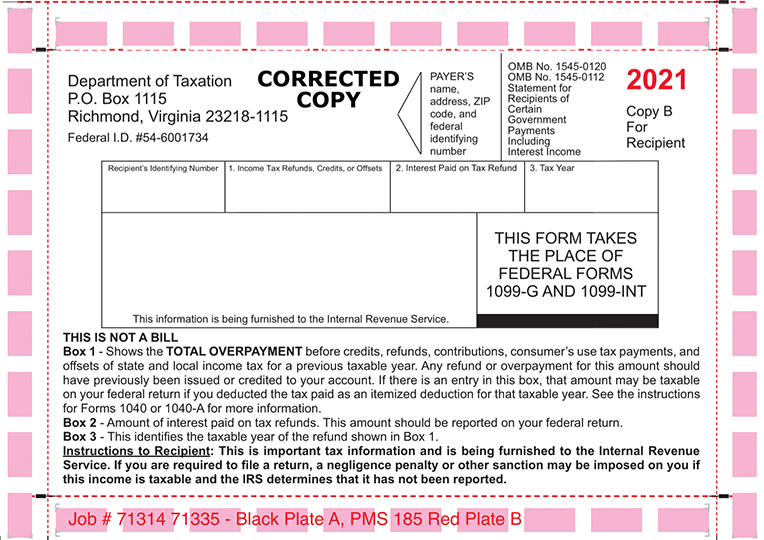

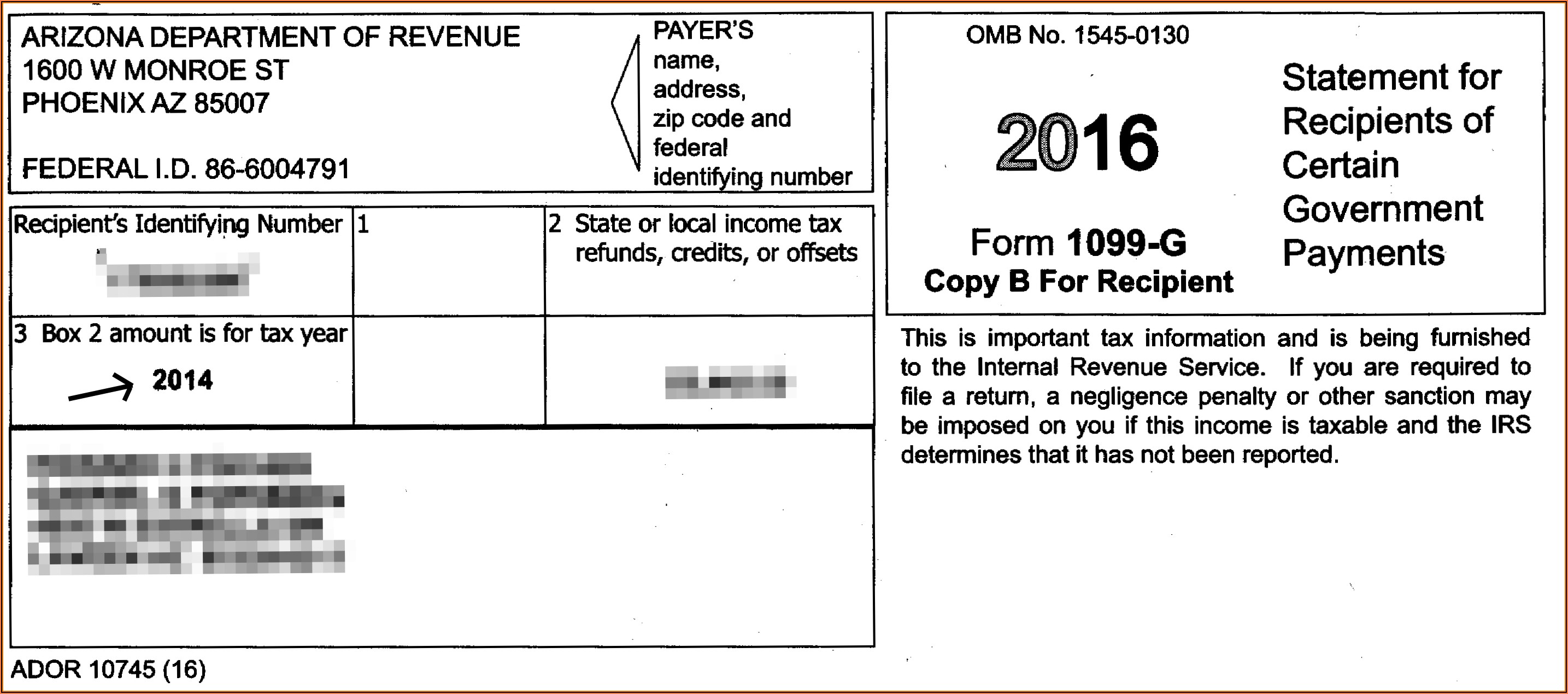

Alright, let’s start with the basics. The Colorado 1099-G form is essentially a document that reports payments made to you by a government entity. Think unemployment benefits, state tax refunds, or any other government-related payments. It’s like a little note saying, “Hey, we gave you some money this year, and it might affect your taxes.”

Here’s the kicker: if you don’t report this correctly, you could end up owing more taxes than you anticipated—or worse, face penalties. But don’t stress; the Colorado 1099-G tax refund process is designed to help you get back any overpaid taxes. It’s all about balance, my friend.

Why Should You Care About the 1099-G Form?

Let me ask you this: do you like keeping more of your hard-earned cash? If the answer is yes (and it better be), then you need to care about the 1099-G form. This little form can make or break your tax situation. Here’s why:

- It reports any government payments you received, which directly impacts your taxable income.

- If you overpaid taxes due to these payments, the Colorado 1099-G tax refund can help you reclaim that money.

- Ignoring it could lead to unnecessary tax liabilities or even audits. Yikes!

Bottom line? The 1099-G form is your key to ensuring you’re not overpaying Uncle Sam—or the State of Colorado.

Who Receives the Colorado 1099-G Form?

Not everyone gets a 1099-G form, so let’s clarify who does. If you fall into any of these categories, buckle up:

Unemployment Benefits Recipients

Did you receive unemployment benefits during the year? Whether it was through regular unemployment or pandemic-related programs, the government wants to know about it. These payments are taxable, and the 1099-G form will report the exact amount you received.

Read also:Who Did Emily Compagno Marry A Comprehensive Look Into Her Personal Life And Career

State Tax Refunds

If you got a state tax refund last year, guess what? That’s taxable too. The Colorado 1099-G form will show the amount of your refund, and you’ll need to include it in your federal tax return.

Other Government Payments

Did you receive any other payments from a government entity, like grants or reimbursements? Yep, those show up on the 1099-G form as well. It’s all about transparency and making sure everyone pays their fair share—or gets their fair refund.

How Does the Colorado 1099-G Affect Your Tax Refund?

Alright, here’s where the rubber meets the road. The Colorado 1099-G form can either increase or decrease your tax refund, depending on how it’s reported. Let’s break it down:

Unemployment Benefits and Taxable Income

Unemployment benefits are considered taxable income, which means they’ll increase your overall tax liability. However, if you overpaid taxes on these benefits, the Colorado 1099-G tax refund can help you recover that money. It’s like getting a second chance to balance the books.

State Tax Refunds and Adjustments

Remember that state tax refund you got last year? Well, if it was more than what you should’ve received, you might owe taxes on the excess amount. Conversely, if you overpaid, the Colorado 1099-G tax refund can help you reclaim that cash. It’s all about accuracy and fairness.

Steps to Claim Your Colorado 1099-G Tax Refund

Ready to claim your refund? Here’s a step-by-step guide to make the process smooth and stress-free:

- Gather all your tax documents, including the 1099-G form.

- Review the amounts reported on the 1099-G form and compare them to your records.

- Complete your federal tax return, making sure to include the 1099-G information accurately.

- Double-check your calculations and ensure everything matches up.

- Submit your tax return electronically or by mail, depending on your preference.

And there you have it—a simple process to claim your Colorado 1099-G tax refund. Easy peasy, right?

Common Mistakes to Avoid with Colorado 1099-G

Let’s be real—taxes can be tricky, and mistakes happen. But here are a few common pitfalls to avoid when dealing with the Colorado 1099-G form:

- Forgetting to report the 1099-G information on your tax return.

- Miscalculating the taxable portion of your unemployment benefits or state tax refund.

- Not double-checking the amounts reported on the form against your own records.

By staying vigilant and double-checking everything, you can avoid unnecessary headaches and ensure a smooth tax filing process.

Tips for Maximizing Your Colorado 1099-G Tax Refund

Who doesn’t love a bigger refund? Here are a few tips to help you maximize your Colorado 1099-G tax refund:

Keep Accurate Records

Having detailed records of all your income and expenses is crucial. It ensures you don’t miss anything important when filing your taxes.

Consult a Tax Professional

If you’re unsure about anything, don’t hesitate to reach out to a tax expert. They can provide guidance and help you navigate complex situations.

Stay Updated on Tax Laws

Tax laws can change frequently, so staying informed is key. Keep an eye on updates from the IRS and Colorado Department of Revenue to ensure you’re compliant.

Real-Life Examples of Colorado 1099-G Tax Refund Success

Let’s look at a couple of real-life examples to see how the Colorado 1099-G tax refund works in action:

Example 1: Unemployment Benefits

Sarah received $10,000 in unemployment benefits last year. When she filed her taxes, she realized she overpaid by $500. Thanks to the Colorado 1099-G tax refund, she was able to reclaim that money and use it to pay off some debt.

Example 2: State Tax Refund

John got a $1,200 state tax refund last year. When he filed his federal taxes, he realized he owed taxes on the excess amount. However, after double-checking his calculations, he discovered an error and successfully claimed his Colorado 1099-G tax refund.

Resources and Tools for Colorado 1099-G Tax Refund

Here are some helpful resources and tools to assist you with your Colorado 1099-G tax refund:

- IRS Website: https://www.irs.gov

- Colorado Department of Revenue: https://www.colorado.gov/pacific/revenue

- TurboTax: A user-friendly tool for filing your taxes online.

These resources can provide valuable information and support as you navigate the Colorado 1099-G tax refund process.

Conclusion: Take Control of Your Colorado 1099-G Tax Refund

Alright, we’ve covered a lot of ground here. To sum it up:

- The Colorado 1099-G form is crucial for reporting government payments and ensuring accurate tax filings.

- By understanding how the form works and avoiding common mistakes, you can maximize your tax refund.

- Stay informed, keep accurate records, and don’t hesitate to seek professional help if needed.

Now, it’s your turn to take action. File your taxes with confidence and make sure you’re not leaving any money on the table. And hey, if you found this guide helpful, don’t forget to share it with your friends and family. Happy tax filing!

Table of Contents:

- What is the Colorado 1099-G Tax Refund All About?

- Why Should You Care About the 1099-G Form?

- Who Receives the Colorado 1099-G Form?

- How Does the Colorado 1099-G Affect Your Tax Refund?

- Steps to Claim Your Colorado 1099-G Tax Refund

- Common Mistakes to Avoid with Colorado 1099-G

- Tips for Maximizing Your Colorado 1099-G Tax Refund

- Real-Life Examples of Colorado 1099-G Tax Refund Success

- Resources and Tools for Colorado 1099-G Tax Refund

- Conclusion: Take Control of Your Colorado 1099-G Tax Refund