So, you're thinking about diving into the world of homeownership, huh? If you're considering Chase home loan pre-approval, you're already on the right track. Getting pre-approved for a home loan is like having a golden ticket in your pocket when you're out there hunting for your dream property. It's not just about knowing how much you can borrow; it's about giving you the confidence to make a move when the perfect house winks at you. Let's face it, in today's competitive market, having that pre-approval letter is like wearing a superhero cape—it sets you apart from the rest.

Now, before we dive headfirst into the nitty-gritty, let’s talk about why Chase home loan pre-approval is such a big deal. Chase Bank, one of the biggest names in the finance game, offers a range of mortgage options tailored to fit different lifestyles and budgets. Pre-approval isn't just a formality; it’s a crucial step that shows sellers you’re serious and financially ready to seal the deal. This process involves a deep dive into your financials, but trust me, it’s worth it.

Whether you're a first-time homebuyer or a seasoned pro looking to upgrade, understanding the ins and outs of Chase home loan pre-approval can save you time, stress, and maybe even some cash. So, grab your favorite drink, get comfy, and let’s break it down step by step. By the end of this, you’ll feel like a mortgage mastermind ready to take on the housing market.

Read also:Lily Phillips Leaked Unveiling The Truth Behind The Controversy

What Exactly is Chase Home Loan Pre-Approval?

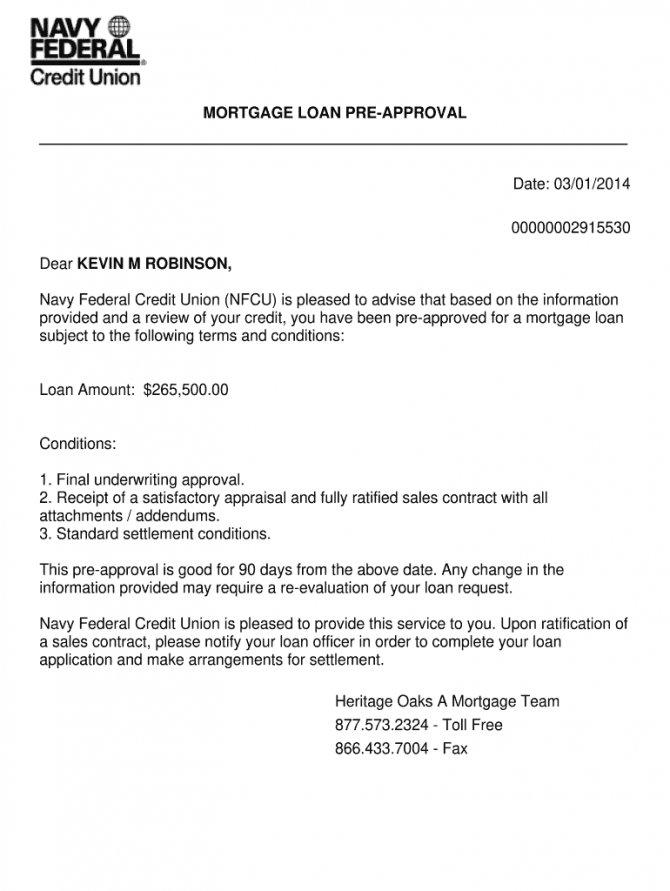

Alright, let's clear the air first. Chase home loan pre-approval is more than just a fancy term thrown around by real estate agents. It’s an official evaluation of your financial situation by Chase Bank to determine how much they’re willing to lend you for a home purchase. Think of it as a pre-game warm-up where Chase checks out your credit score, income, debts, and other financial factors to decide if you're a good candidate for a mortgage.

This process doesn’t just happen overnight. You’ll need to gather some key documents, like your tax returns, pay stubs, bank statements, and proof of any other assets you might have. Chase will then crunch the numbers and give you a pre-approval letter stating the maximum loan amount you qualify for. It’s like getting a VIP pass to the homebuying party, letting sellers know you’re legit and ready to negotiate.

Why Chase Home Loan Pre-Approval Matters

Here’s the thing: in today’s fast-paced real estate world, having Chase home loan pre-approval can be a game-changer. Sellers aren’t just looking for buyers who are interested—they want buyers who are prepared. A pre-approval letter signals to sellers and their agents that you’ve already jumped through the financial hoops and are ready to close the deal quickly.

Plus, it helps you stay within your budget. Knowing exactly how much you can borrow keeps you from falling in love with homes that are out of your price range. It’s like having a financial compass that guides you through the maze of listings and open houses. And let’s not forget, it gives you leverage during negotiations. Sellers love buyers who are pre-approved because it reduces the risk of the deal falling through due to financing issues.

How to Get Chase Home Loan Pre-Approval

Now that you know why pre-approval is a must-have, let’s talk about the how. Getting Chase home loan pre-approval isn’t as daunting as it sounds. It’s a straightforward process that involves a few key steps. First up, you’ll need to gather all your financial documents. Chase will want to see your last two years of tax returns, recent pay stubs, bank statements for the past two months, and any other asset documentation you might have.

Once you’ve got your ducks in a row, you can apply online or visit a Chase branch to start the process. Chase will review your documents, check your credit score, and calculate your debt-to-income ratio. If everything checks out, they’ll issue you a pre-approval letter. This letter is your golden ticket to the homebuying world, so keep it safe and handy when you start house hunting.

Read also:How Often Does Trump Eat Mcdonalds A Comprehensive Look Into His Fast Food Habit

Key Documents You’ll Need

- Last two years of tax returns

- Recent pay stubs (usually from the last 30 days)

- Bank statements for the past two months

- Proof of other assets (investment accounts, retirement funds, etc.)

- Identification documents (driver’s license, passport, etc.)

Having all these documents ready will speed up the process and increase your chances of getting pre-approved. Remember, the more organized you are, the smoother the process will be.

Understanding Chase Mortgage Options

Chase offers a variety of mortgage options tailored to fit different financial situations and lifestyles. Whether you’re a first-time homebuyer or looking to refinance, Chase has got you covered. Some of the popular options include fixed-rate mortgages, adjustable-rate mortgages, FHA loans, and VA loans. Each option comes with its own set of benefits and considerations.

Fixed-rate mortgages offer stability with a consistent interest rate throughout the life of the loan. Adjustable-rate mortgages, on the other hand, offer lower initial rates that can adjust over time. FHA loans are great for first-time buyers with lower down payment requirements, while VA loans are exclusive to veterans and offer incredible benefits like no down payment.

Choosing the Right Mortgage for You

Choosing the right mortgage is like picking the perfect outfit—it needs to fit your style and situation. Consider factors like your budget, how long you plan to stay in the home, and your comfort level with interest rate fluctuations. Fixed-rate mortgages are ideal if you want predictability and budget consistency, while adjustable-rate mortgages might be better if you plan to move in a few years.

Talk to a Chase mortgage specialist to explore your options and find the best fit for your financial goals. They can help you understand the pros and cons of each type of loan and guide you toward the best choice for your unique situation.

Common Misconceptions About Chase Home Loan Pre-Approval

There are a few myths floating around about Chase home loan pre-approval that might be holding you back. One common misconception is that pre-approval is the same as pre-qualification. While both involve an assessment of your financial situation, pre-qualification is a more informal process and doesn’t carry the same weight as pre-approval. Pre-approval requires a thorough review of your financials and results in an official letter, whereas pre-qualification is more of a ballpark estimate.

Another myth is that pre-approval locks you into a mortgage with Chase. This isn’t true. Pre-approval simply gives you an idea of what you can afford and shows sellers you’re serious. You’re still free to shop around and compare offers from other lenders. Lastly, some people think that pre-approval is only for first-time buyers. Not true! It’s beneficial for anyone looking to buy a home, regardless of their experience level.

Debunking the Myths

- Pre-approval is not the same as pre-qualification

- Pre-approval doesn’t lock you into a mortgage with Chase

- Pre-approval is beneficial for all homebuyers, not just first-timers

Understanding these differences can help you make informed decisions and avoid unnecessary stress during the homebuying process.

Improving Your Chances of Getting Pre-Approved

Want to increase your chances of getting Chase home loan pre-approval? There are a few things you can do to strengthen your financial profile. Start by improving your credit score. Pay down any outstanding debts, make all your payments on time, and avoid opening new lines of credit while you’re in the pre-approval process.

Another tip is to boost your savings. Having a healthy down payment and emergency fund can make you a more attractive candidate to lenders. Chase also looks favorably on borrowers with stable employment history, so if you’ve been job-hopping, consider sticking with one employer for a while before applying.

Tips for Strengthening Your Financial Profile

- Improve your credit score by paying down debts and making timely payments

- Boost your savings for a solid down payment and emergency fund

- Maintain a stable employment history

By taking these steps, you’ll be in a much stronger position when applying for Chase home loan pre-approval.

Common Challenges in the Pre-Approval Process

Even with the best preparation, there can be challenges during the Chase home loan pre-approval process. One common issue is having a low credit score. If your score isn’t where it needs to be, it might affect your chances of getting pre-approved or result in less favorable terms. Another challenge is having too much debt relative to your income. Chase uses a debt-to-income ratio to assess your ability to repay the loan, so high debt levels can be a red flag.

Self-employed individuals might also face hurdles due to inconsistent income. Chase may require additional documentation to verify your earnings, which can slow down the process. If you encounter any of these challenges, don’t panic. Work with a Chase mortgage specialist to address the issues and find solutions that work for you.

Overcoming Challenges

- Work on improving your credit score before applying

- Reduce your debt-to-income ratio by paying down debts

- Provide detailed documentation if you’re self-employed

By addressing these challenges head-on, you can increase your chances of a successful pre-approval.

Benefits of Chase Home Loan Pre-Approval

Now that we’ve covered the process and potential challenges, let’s talk about the benefits of Chase home loan pre-approval. First and foremost, it gives you a clear idea of your budget. Knowing exactly how much you can borrow helps you focus your home search on properties that fit your financial situation. It also speeds up the buying process since you’ve already cleared the financial hurdles.

Another big benefit is the competitive edge it gives you in the market. Sellers are more likely to take your offer seriously if you’re pre-approved, especially in a competitive market where multiple buyers are vying for the same property. Plus, it gives you peace of mind knowing you’re financially ready to take the next step toward homeownership.

Why Chase Pre-Approval Stands Out

Chase stands out from other lenders with its robust pre-approval process and excellent customer service. Their online application platform makes it easy to submit your documents and track your progress. Plus, their experienced mortgage specialists are there to guide you every step of the way, offering personalized advice and support.

Chase also offers a variety of mortgage options, giving you flexibility to choose the best loan for your needs. Whether you’re buying your first home or refinancing, Chase has the tools and expertise to help you achieve your homeownership goals.

Final Thoughts: Your Path to Homeownership

Getting Chase home loan pre-approval is a crucial step on your journey to homeownership. It’s more than just a formality—it’s a powerful tool that gives you the confidence and leverage you need to navigate the housing market. By understanding the process, gathering the necessary documents, and addressing any potential challenges, you’ll be well on your way to securing your dream home.

So, what are you waiting for? Take the first step today and apply for Chase home loan pre-approval. Once you have that pre-approval letter in hand, you’ll be ready to hit the ground running in your home search. Remember, the housing market isn’t waiting for you, so make sure you’re prepared to seize the opportunities that come your way.

Got questions or need more info? Drop a comment below or share this article with your friends who might be in the same boat. Let’s make homeownership dreams come true, one pre-approval at a time!

Table of Contents

- What Exactly is Chase Home Loan Pre-Approval?

- Why Chase Home Loan Pre-Approval Matters

- How to Get Chase Home Loan Pre-Approval

- Key Documents You’ll Need

- Understanding Chase Mortgage Options

- Choosing the Right Mortgage for You

- Common Misconceptions About Chase Home Loan Pre-Approval

- Debunking the Myths

- Improving Your Chances of Getting Pre-Approved

- Tips for Strengthening Your Financial Profile

- Common Challenges in the Pre-Approval Process